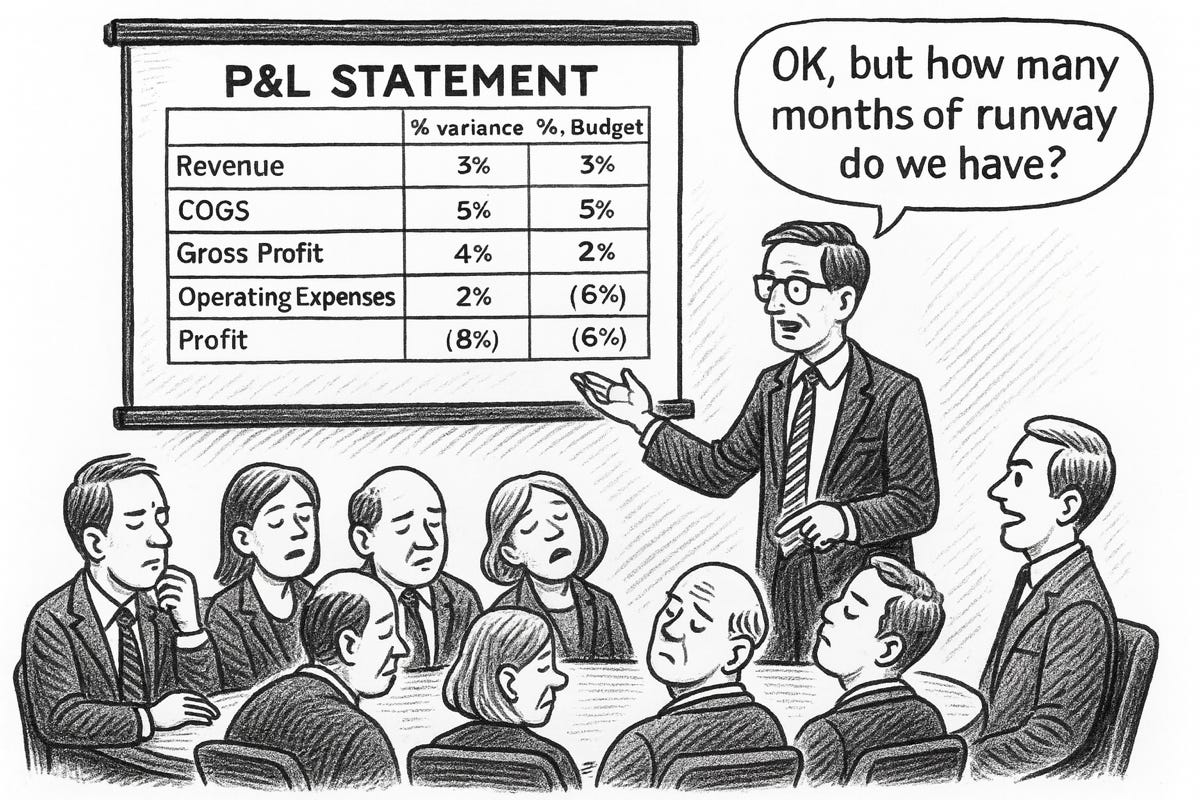

🤷 Nobody cares about your P&L

Until they do..

Welcome to a series of posts that I’m gonna call “learnings that surprise you when joining your first startup”. The titles might be a bit clickbait-y, but take them as intended - with a grain of salt. (There are no absolute truths in this world, but that’s a whole separate rant) I hope you’ll enjoy these bits - leave a comment if you think they are totally off!

If you’re coming from accounting/controlling, this one might sting: nobody cares about the P&L. At least not in the way you’re used to. In early-stage startups, your job is of course to make sure the P&L is correct. But for the most part, nobody else will care. They might nod (sleepily) when you talk through budget vs. actuals, but their minds will be elsewhere..

What really matters

In a high-growth early-stage company, the P&L is full of background noise. It’s useful internally for finance, but management, investors, and the board are not making decisions based on a clean revenue recognition schedule. They care about something much simpler: survival and growth.

Here’s what actually matters early on (in order of importance):

Cash & burn: How much do we have? What’s runway and spend for the next 3, 6, 12, 24 months?

Unit economics: LTV:CAC, CAC Payback, Margins, GRR, NRR

Warning signs: Can we sustain growth? Are we building pipeline? Are we investing too much / too little?

Levers: If growth stalls, can we cut spend & reach profitability? How does the underlying business perform?

The board doesn’t care if your variance to budget is 2% or 5%; they care about growth. Can you deploy more capital to grow faster? Are your unit economics holding? Can you pivot to profitability and extend runway if needed?

Real startup finance - in practice

When you’re in hyper-growth mode, you should be building like water flows; following the path of least resistance. Instead of trying to get the perfect SaaS P&L or build the perfect data warehouse, find ways achieving your goal.

I’ve worked with early stage startups where we built the reporting stack based on:

CRM data (tracking sales-led growth & ARR as north star metric)

Payroll data (for CAC spend)

Marketing data (directly from marketing team)

Using those data sources, we created our reports within days after month end. The P&L still took about 10-12 days to close (outsourced to external bookkeepers), but we didn’t need that; we just needed enough data to get our directional CAC and ARR metrics.

Of course the finance team reviewed the P&L, made sure to align if we were directionally going off budget or shifting spend; but our north star was growing ARR and monitoring the CAC, so we found ways to surface that and create common language across GTM and finance functions.

Your job as CFO at this stage

As CFO, your job is of course to monitor cash movements; and always have a solid liquidity model in place. Keep it as simple as possible; if you’re getting annual payments, model in your ARR for your cash flow, don’t focus too much on revenue recognition. That of course has to be done (at least annually for smaller companies), and later you’ll start reporting a more extensive P&L. But when you’re small, lean and in hyper-growth, simplicity and focus matters more than a full blown P&L that nobody cares about.

Once the company matures and you can justify insourcing more functions and building out a finance team, start adding more complexity. At that point, spending more time on revenue recognition, accruals and accounting principles is going to make more sense. Just don’t invest here too early; keep narrowing down your focus to what really matters for the business until you can afford the overhead.

Yes, the P&L will matter - eventually

As your company scales, board, auditors and future investors/acquirers will care deeply about true & complete financial statements. But if you’re joining an early stage startup, be careful you don’t fall into the rabbit holes. Focus on the fundamentals; business drivers and cash, unit economics and growth. Everything else is noise at the early stage.